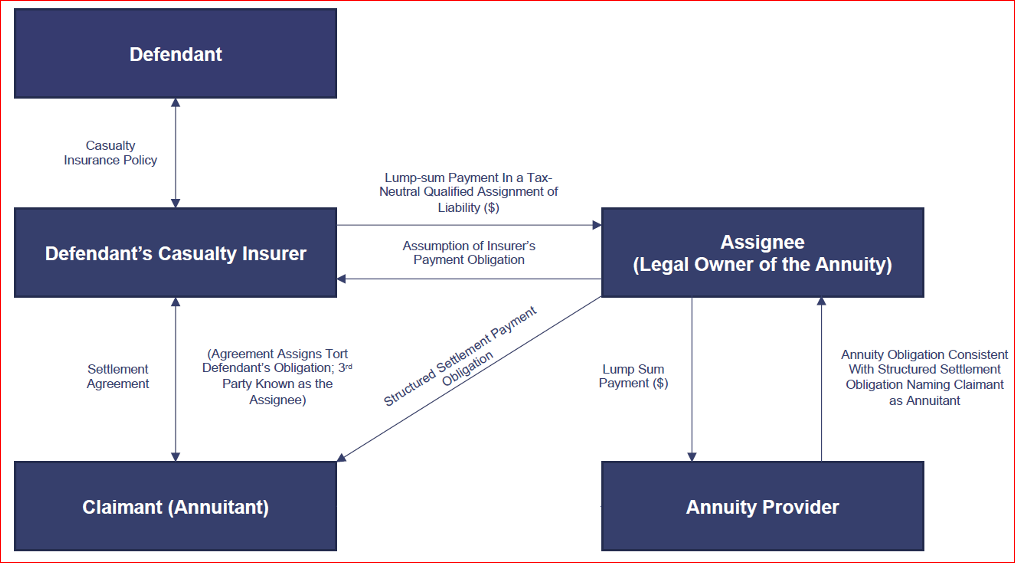

Structured settlements are financial arrangements typically awarded to plaintiffs in personal injury or wrongful death lawsuits. These settlements are paid out over time in regular installments, rather than as a single lump sum. While they offer long-term financial stability to recipients, some individuals choose to sell their future payments for immediate cash. This is where investors and institutions step in to buy structured settlements.

What Does It Mean to Buy Structured Settlements?

Buying structured settlements involves purchasing the rights to future annuity payments at a discounted rate. Investors provide a lump-sum payment to the seller (the original recipient), and in return, they receive the future payments, often guaranteed by highly rated insurance companies.

For example, if a person is set to receive $100,000 over the next 10 years, an investor might purchase that stream of income for $70,000 today, depending on the payment schedule and discount rate. The buyer profits from the difference between the discounted purchase price and the full value of the annuity payments over time.

Why Buy Structured Settlements?

-

Stable, Predictable Returns

Structured settlements typically involve fixed payments over a set period. This makes them an appealing option for investors seeking low-risk, predictable income. -

Backed by Insurance Companies

Most structured settlements are issued by reputable life insurance companies, which enhances the security of the investment. -

Diversification

Structured settlements can help diversify a portfolio away from traditional market-based investments like stocks and bonds. -

Discounted Purchase Price

Since structured settlements are purchased at a discount, investors can potentially realize significant returns over time.

Who Buys Structured Settlements?

-

Private Investors

Individuals looking for fixed income streams may purchase structured settlements as part of their retirement or long-term investment strategy. -

Institutional Buyers

Companies and investment firms often buy structured settlements in bulk, pooling them into portfolios for long-term income generation. -

Settlement Purchasing Companies

These companies specialize in connecting sellers and buyers, handling legal and administrative aspects of the transaction.

Legal and Ethical Considerations

Buying structured settlements is legal, but it must be approved by a court to ensure that the seller is making an informed decision and that the sale is in their best interest. Transparency, compliance with state laws, and ethical business practices are essential for all parties involved.

Ready to Invest in Structured Settlements?

If you’re looking for a safe and reliable way to earn long-term income, buying structured settlements could be the right choice. Whether you’re an individual investor or a financial institution, this unique asset class offers attractive returns with minimal risk.